The Mira Network Airdrop presents an exciting opportunity for users to earn rewards while exploring innovative AI and blockchain solutions. Whether you’re new to blockchain or a seasoned participant, engaging with the Mira Network Airdrop program via the Klok app is an easy and rewarding way to get involved. Keep engaging with the AI chat, share your referral link, and watch your points accumulate as Mira Network prepares to take the next big step in AI verification.

Participate today, and you could be part of something big tomorrow!

Table of Contents

Introduction to Mira Network and Its Vision

Mira Network is revolutionizing the intersection of artificial intelligence (AI) and blockchain. The decentralized platform aims to make AI technology more accessible, reliable, and trustworthy. By integrating blockchain, Mira ensures the verification of AI-generated outputs. This innovative approach guarantees that users receive accurate and dependable results.

Mira Network collaborates with leading partners like io.net, Hyperbolic, Aethir, Spheron, and Exabits. Together, they create a decentralized physical infrastructure network (DePIN). Through this partnership, Mira leverages distributed GPU computing power, which helps speed up AI output validation.

With significant backing from investors, including Framework Ventures, Mira Network’s model shows promising growth. By reducing reliance on expensive centralized data centers, Mira aims to provide high-quality, efficient AI output validation.

Mira Network Airdrop: A Great Opportunity for Users

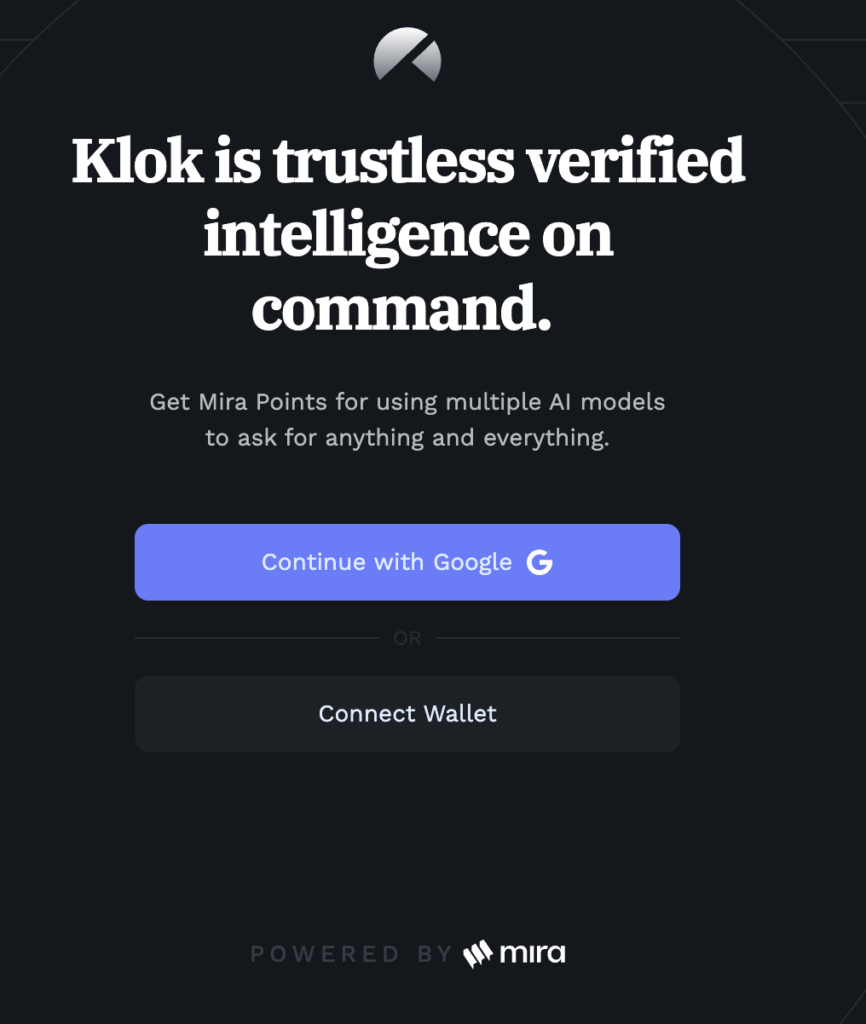

Mira Network has launched an exciting opportunity for users to participate in their airdrop program via the Klok app. This new initiative allows users to earn points by interacting with AI features on the platform. While the airdrop has not been officially confirmed yet, engaging in the program could lead to future rewards in the form of Mira Network’s tokens.

The airdrop is an open, no-cost initiative that requires no initial investment. All users need to do is actively participate in daily AI engagement. Plus, there’s a referral system to help boost your point accumulation. This system rewards you with additional points for bringing others into the fold.

Participating in the Mira Network Airdrop is straightforward and gives everyone a chance to earn rewards while exploring the future of AI and blockchain technology.

How to Get Started with the Mira Network Airdrop

If you’re ready to get started with the Mira Network Airdrop, follow these simple steps to begin earning points:

- Visit the Klok Website: Head to the Klok platform, which offers a trustless and verified AI chat service.

- Connect Your Wallet: Ensure you connect an EVM-compatible wallet like MetaMask or Rabby to the platform.

- Verify Wallet Connection: Sign the request to confirm your wallet connection.

- Engage with AI Chat: Interact with the AI chat daily to earn 10 points per day.

- Referral System: Obtain your unique referral link from the platform and share it with others.

- Earn Extra Points: For every referral, you earn additional points, boosting your total rewards.

By following these easy steps, you can quickly start participating in the Mira Network Airdrop and make the most of your interactions with the platform’s AI features.

Tips for Maximizing Your Mira Network Airdrop Rewards

Maximizing your earnings from the Mira Network Airdrop is all about engagement and sharing. Here are some proven tips to help you get the most out of the program:

- Daily Engagement: Make it a habit to engage with the AI chat every day. Each interaction earns you up to 10 points daily, so consistent participation will help you accumulate rewards quickly.

- Referral Program: Share your unique referral link across your social media channels. This allows you to earn bonus points whenever someone signs up through your link.

- Track Your Progress: Monitor your points and referral status regularly. Staying on top of your progress ensures you don’t miss any potential rewards or bonuses.

- Meaningful Interactions: You can earn a maximum of 100 points per day through meaningful engagements. Make sure your interactions with the AI are helpful and relevant to maximize your point accumulation.

By following these strategies, you can optimize your experience and increase your chances of receiving Mira Network tokens once the airdrop officially kicks off.

Why Mira Network Airdrop is a Game-Changer

The Mira Network Airdrop is not just another token giveaway. It’s an opportunity to be part of a groundbreaking project that combines the power of AI and blockchain technology. By participating, you gain early access to a platform that’s poised to shape the future of AI verification.

The Mira Network’s decentralized approach ensures that AI outputs are not only accurate but also trustworthy. With the backing of top investors and a growing network of partners, Mira Network is well-positioned to lead the way in decentralized AI validation.

Don’t miss your chance to get involved in the Mira Network Airdrop. By earning points today, you may unlock future rewards that will shape your involvement in this transformative project.