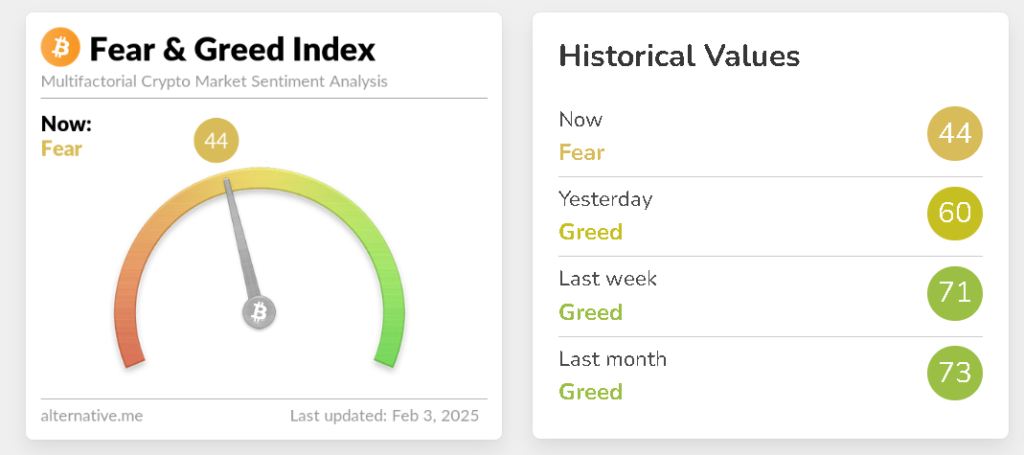

The memecoin market, which surged to unprecedented heights recently, has experienced a dramatic decline, shedding nearly $50 billion in market valuation since the launch of President Donald Trump’s official memecoin, TRUMP. Here’s an analysis of what’s happening in the memecoin market and what could be behind the significant losses.

TRUMP Memecoin Leads to Market Dip

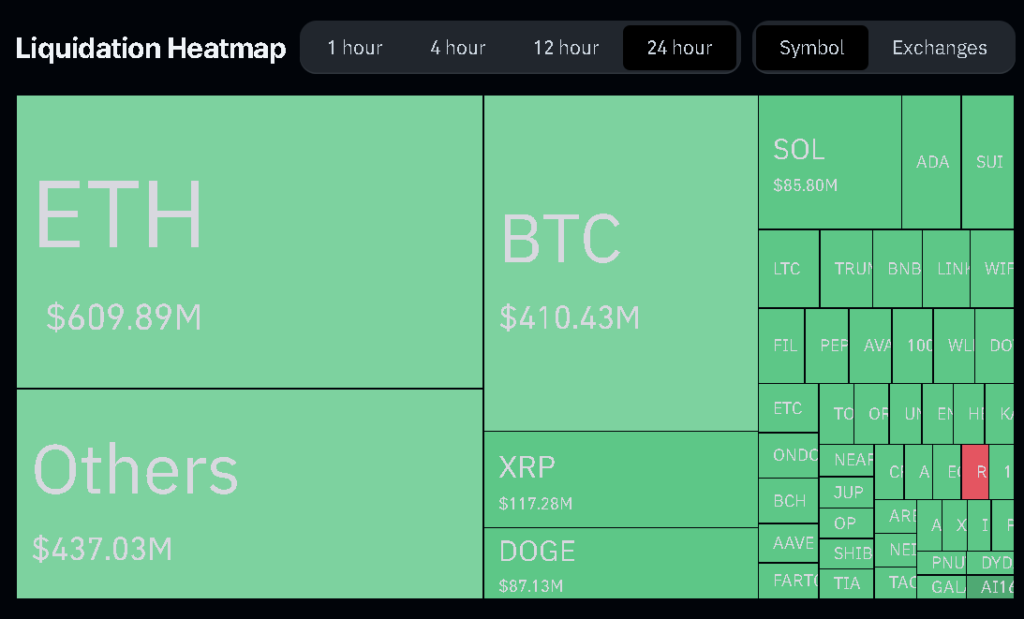

The memecoin market experienced a significant rise in early January, reaching a total market capitalization of $117 billion following the launch of TRUMP on January 17. However, within just three weeks, the total market cap has dropped by over 40%, now sitting at around $70 billion. This represents a massive loss of $47 billion, with the memecoin market falling $56 billion from its all-time high in December.

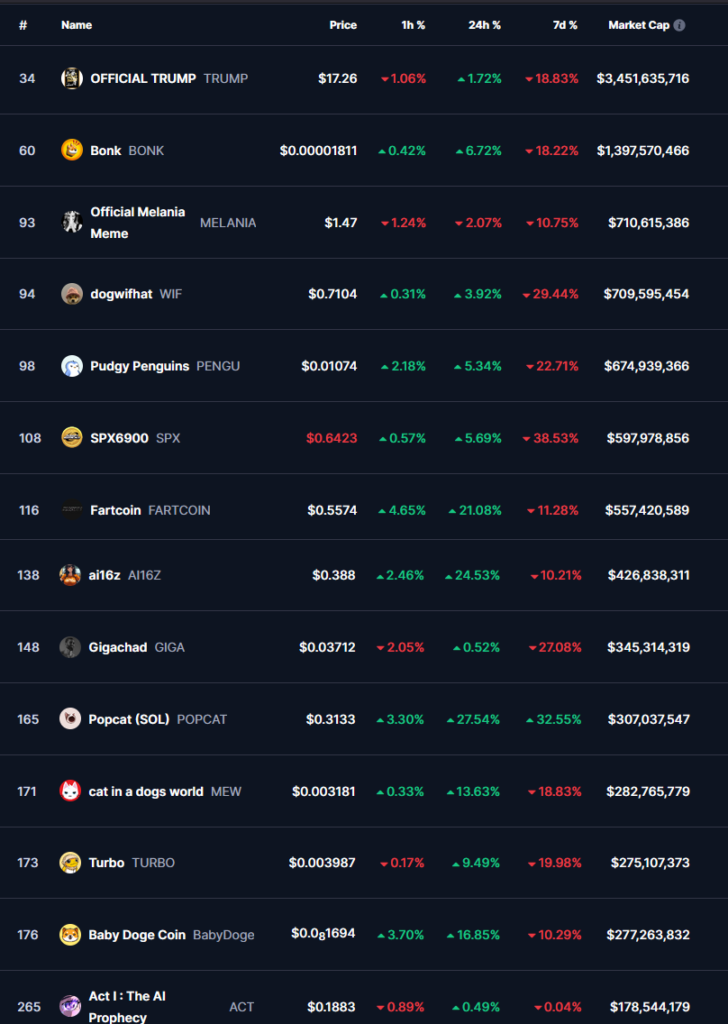

Major Memecoins Suffer Significant Losses

Several of the top memecoins have taken a hit during this downturn. Dogecoin (DOGE), the largest memecoin by market cap, has dropped 25% over the past week. Other popular memecoins such as PEPE, WIF, and FARTCOIN have suffered even larger declines:

- PEPE: Down 35%

- WIF: Down 42%

- FARTCOIN: Down 55%

The downturn was further exacerbated by a controversy surrounding the WIF token. The memecoin’s official page had announced that the DogWifHat would be showcased on the Las Vegas Sphere after raising nearly $700,000 from the community in March 2024. However, less than a week later, it was revealed that Vegas Sphere officials had denied any collaboration, accusing the WIF team of misleading the community. Despite the backlash, the announcement remains on the WIF token’s page, claiming that the dates will be revealed “as soon as we are allowed to share.”

Are Memecoins Really Dead? Experts Still Hold Optimistic Views

While many in the market are calling the end of the memecoin trend, some key figures, such as Murad Mahmudov, remain bullish on the future of memecoins. Mahmudov believes that certain memecoins still have massive potential and could reach tens of billions in valuation over the next few months. He advises focusing on coins that are “hustling, vibing, bullposting, and diamondhanding”—regardless of price fluctuations.

Pay Attention to Coins that are Hustling, Vibing, Bullposting, Showing up and Diamondhanding *regardless of Price*

— Murad 💹🧲 (@MustStopMurad) February 5, 2025

Those are the ones that will go to Tens of Billions in a few months.

The TRUMP and MELANIA Memecoin Launches: A Liquidity Shift?

The sudden drop in the memecoin market could be attributed to a massive liquidity shift, as traders quickly dumped their holdings in favor of the TRUMP token. The launch of the TRUMP memecoin might have triggered a market frenzy, only for its value to plummet shortly thereafter, leaving many traders with heavy losses.

Additionally, the launch of the MELANIA token, just 48 hours after TRUMP, further drained liquidity. On its opening day, MELANIA saw a rapid rise to a $13 billion valuation, which directly impacted TRUMP’s value. As a result, TRUMP experienced a 50% drop, and both tokens have continued to decline since their initial surges. TRUMP is currently valued at $17 billion, while MELANIA stands at $1.3 billion.

Is the Memecoin Boom Over?

While the memecoin market has seen a significant downturn, it is important to recognize that this space is highly volatile. Although the TRUMP and MELANIA memecoin launches triggered large shifts in market sentiment and liquidity, some investors remain optimistic. Only time will tell if the memecoin market is truly dead or if it’s simply experiencing a temporary correction before another wave of growth.