Author: Ekene Anthony

Ripple Expands RLUSD Stablecoin with Additional Minting: What You Need to Know

Ripple, the prominent blockchain company based in San Francisco, has recently minted an additional 1 million RLUSD tokens, bringing the total supply to new heights. This update, tracked by @RL_Tracker, is just the latest in Ripple’s growing stablecoin ecosystem.

Ripple's Milestone: 1 Million RLUSD Tokens Minted

Earlier in February, Ripple minted 2 million RLUSD tokens on February 1, further boosting the supply of its dollar-pegged stablecoin. The stablecoin, RLUSD, surpassed a major milestone in January 2025, reaching a market capitalization of over $100 million. This latest minting underscores Ripple’s continued commitment to the growth and stability of its stablecoin offering.

Celebrating Growth: Ripple’s Vision for Stablecoins

Ripple CEO Brad Garlinghouse expressed his excitement about the achievement, marking it as a significant step in the company’s blockchain journey. Jack McDonald, Ripple’s Senior Vice President of Stablecoins, also noted the “amazing traction” stablecoins have gained in the market, reflecting a growing trend toward decentralized finance solutions.

RLUSD Stablecoin Reaches $110 Million Market Cap

As of now, RLUSD’s market capitalization stands at an impressive $110 million, according to data from CoinGecko. Ripple President Monica Long highlighted the importance of trust and compliance in the rapidly expanding stablecoin market. She explained that RLUSD represents a seamless bridge between traditional finance and blockchain technology.

RLUSD on Global Exchanges

RLUSD, Ripple’s dollar-pegged stablecoin, was first introduced to global exchanges on December 17, 2024, following approval from the New York Department of Financial Services (NYDFS). It has already been listed on major exchanges such as Bitstamp, and Ripple has plans for further listings as the stablecoin gains traction.

DeFi Integration and AMMClawback Amendment

One of the most exciting developments for RLUSD is its recent integration into decentralized finance (DeFi) pools. Thanks to the AMMClawback amendment on the XRP Ledger, RLUSD can now be used in DeFi pools with the added benefit of token recovery in case of misuse. The XRP/RLUSD pool currently holds $1.3 million in liquidity, showcasing the growing use of RLUSD in the DeFi space.

The Future of Stablecoins: Ripple's Strategic Approach

Ripple’s RLUSD is making a significant impact in the blockchain and cryptocurrency landscape. The company’s focus on regulatory compliance, trust, and innovative technology positions RLUSD as a promising player in the evolving stablecoin market.

With more exchanges listing RLUSD and its growing adoption in decentralized finance, Ripple’s dollar-pegged stablecoin is set to play a crucial role in the future of digital finance.

Charles Hoskinson Discusses RLUSD Negotiations with Ripple and Cardano's Future in Blockchain

Charles Hoskinson, the founder of Cardano (ADA), recently shared insights about potential negotiations involving RLUSD and his ongoing talks with Ripple representatives. In a candid conversation during a YouTube AMA session, Hoskinson elaborated on the state of discussions with Ripple’s leadership and offered his perspective on the future of Cardano and blockchain technology.

Cardano’s Future in Blockchain: Talks with Ripple Leaders

Hoskinson revealed that he has been in talks with Ripple’s Brad Garlinghouse and David Schwartz regarding RLUSD. While negotiations are progressing, he emphasized that Ripple has requested a delay until March due to their ongoing work with the New York Department of Financial Services (NYDFS). Despite this temporary hold, Hoskinson remains optimistic about the potential for collaboration. “We talked to David Schwartz and Brad Garlinghouse. There is a strong possibility we can negotiate RLUSD. Ripple told us to wait till March, as they just finished NYDFS,” Hoskinson mentioned during the AMA.

Cardano's Performance Amid Market Volatility

While the cryptocurrency market has experienced a downturn, Hoskinson remains confident about Cardano’s performance. Over a recent 24-hour period, Cardano’s price dropped by 19%, and it saw a 23% decrease over the past week. However, compared to major cryptocurrencies like Dogecoin, Solana, and Binance Coin (BNB), Cardano’s losses were relatively less severe.

Hoskinson pointed out that the market’s current volatility is partially linked to overblown expectations, especially surrounding Bitcoin’s performance during Donald Trump’s presidency. He expressed optimism, stating that the long-term future of the cryptocurrency market remains positive, despite short-term fluctuations.

Blockchain Technology: A Critical Component of Future Government Systems

Looking ahead, Hoskinson envisions a pivotal role for blockchain technology in governmental frameworks. He predicts that within five years, blockchain will be widely integrated into key aspects of government functions, including voting, purchasing, and identity management.

Hoskinson also suggested that a Bitcoin reserve could be established by the U.S. government, potentially backed by Cardano. This move would not only enhance the DeFi landscape but also strengthen Cardano’s role in the blockchain ecosystem.

Final Thoughts: A Bright Future for Cardano and Blockchain Technology

Despite the current challenges in the crypto market, Charles Hoskinson remains committed to the long-term vision for Cardano and the blockchain industry. His insights into future collaborations with Ripple, the evolving role of blockchain in government systems, and Cardano’s potential in decentralized finance position Cardano to thrive as a key player in the future of blockchain technology.

Errol Musk Joins the Celebrity-Backed Crypto Craze with MUSKIT Meme Coin

Celebrity-backed cryptocurrencies have been creating waves in the crypto space, and the latest name to jump into the trend is none other than Errol Musk, the father of tech mogul Elon Musk. Errol is making headlines with his upcoming meme coin, *MUSKIT*, and the crypto community is already reacting to the buzz.

MUSKIT Meme Coin Set to Raise $200 Million

Errol Musk is planning to raise up to $200 million with the launch of his MUSKIT token. Launched by a Middle Eastern crypto firm in December 2024, MUSKIT has already started to gain momentum. The new meme coin has surged in price, making waves across the market as it’s tied to the Musk family name. The funds raised from MUSKIT will reportedly go toward supporting the Musk Institute, a for-profit think tank that Errol Musk co-founded with Nathan Browne. The Musk Institute aims to focus on groundbreaking projects such as flying vehicles and scientific research.

Errol Musk is embracing the family name with his venture, declaring, “I’ve been ‘Musking it’ for years,” signaling his long-time involvement in the world of innovation.

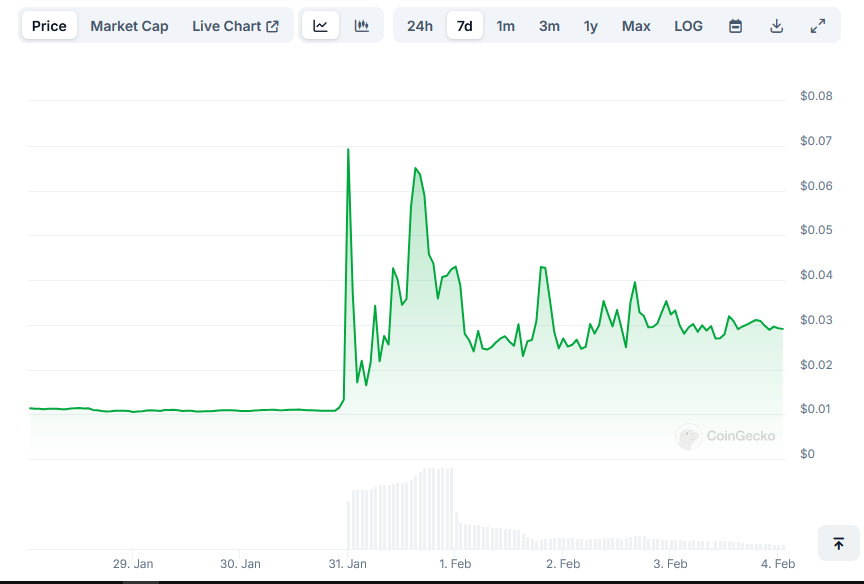

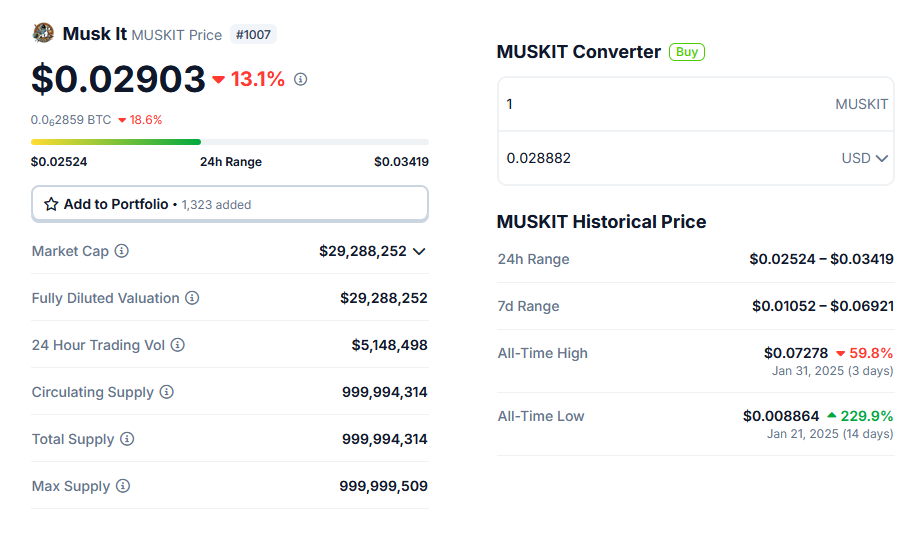

MUSKIT Coin: A Roller Coaster Ride of Price Fluctuations

Following the announcement of *MUSKIT*, the coin saw a massive 200% increase in value, only to plummet shortly after, now hovering around $0.065. Despite the early gains, many crypto traders are skeptical about MUSKIT’s future performance. Experts have raised concerns over the coin’s structure, transparency, and potential risks. The lack of clear information surrounding the supply and ownership distribution is a significant point of worry, as reports suggest that Errol Musk’s company may hold up to 80% of the coin’s total supply.

With these uncertainties, some analysts speculate that a potential “rug pull” could be in the cards for MUSKIT, leaving investors at risk of significant losses. The use of branding and imagery closely associated with Elon Musk’s companies has raised red flags, as some believe it could mislead investors into thinking Elon Musk is involved in the project.

Celebrity Meme Coins: A Risky Investment Trend

While MUSKIT rides the waves of the celebrity-backed meme coin trend, there are growing concerns about the sustainability of such projects. Historically, celebrity-driven meme coins tend to experience a surge in value, followed by a sharp decline, often leaving late investors at a loss. As MUSKIT fluctuates in value, traders are questioning whether the coin is already “dead” or if it still holds potential for recovery. With the price already dropping and uncertainty surrounding its structure, investors are on edge.

New York Court Sentences Ponzi Scheme Promoter to 30 Months in Prison

Antonia Perez Hernandez's Role in the Forcount Ponzi Scheme

On January 27, 2025, U.S. District Judge Analisa Torres sentenced Antonia Perez Hernandez, a key figure in the Forcount Ponzi scheme, to 30 months in prison. Hernandez, a Tampa resident, had previously pleaded guilty to conspiracy to commit wire fraud in connection with the fraudulent activities that stole millions from unsuspecting investors.

The Deceptive Operation: Forcount's Promise of Guaranteed Returns

Forcount, a supposed cryptocurrency trading and mining company, claimed to offer investors the chance to double their money in just six months. From 2017 to 2021, Hernandez and others lured individuals into investing by promoting the company’s fake operations. In reality, the company did not engage in legitimate business activities. Instead, it deceived investors by giving them access to an online portal that showed imaginary profits. However, most investors were unable to withdraw any funds, and those who did received money from new investors rather than company earnings.

Mindexcoin: The Next Step in the Scam

When investor complaints began to grow, Hernandez and two co-conspirators, Juan Tacuri and Nestor Nuñez, launched a new scam involving a proprietary crypto token, “Mindexcoin.” They promised that the token’s value would rise once it was accepted by mainstream merchants.

Indictments and Guilty Pleas: A Long-Running Investigation

In December 2022, Hernandez, Tacuri, Nuñez, and others were indicted, with Forcount founder Francisley Da Silva also named in the case. The group was involved in a broader crypto Ponzi scheme, including a separate scam. Tacuri pled guilty in June 2024, and other conspirators followed suit. While Tacuri received a 20-year sentence and was ordered to forfeit $3.6 million in illicit earnings, Nuñez was sentenced to just four years for his part.

Hernandez's Sentencing: Victims Speak Out

At her sentencing, Judge Torres sentenced Hernandez to 30 months in prison, in line with recommendations from the U.S. Attorney’s office. Although Hernandez wasn’t the mastermind behind the scheme, Judge Torres noted that she played a crucial role in promoting the fraudulent token. During the hearing, victims shared their harrowing stories, describing the emotional and financial toll the scam had taken on their lives. Some victims revealed that they had lost their retirement savings, and others even experienced marital breakdowns due to the devastating consequences of the scam.

Hernandez Expresses Remorse, But Victims Seek Justice

Hernandez apologized for her actions during the hearing, expressing remorse for the pain she caused. Meanwhile, the leader of the scam, Francisley Da Silva, remains in custody in Brazil as the legal process continues for other individuals involved in the scheme.

HIVE Digital Acquires Bitfarms' Yguazú Bitcoin Mining Facility for $56 Million, Expanding Global Mining Capacity

HIVE Digital has successfully concluded the acquisition of a partially completed Bitcoin mining facility from Bitfarms, located in Yguazú, Paraguay. The deal, valued at $56 million, grants HIVE control of the 200-megawatt site, which is set to be developed further into a fully operational mining hub.

The payment structure for the transaction involves an initial sum of $25 million, which is due at the closing of the deal in the first quarter of 2025. The remaining $31 million will be paid in six equal monthly installments, offering a clear payment schedule for the acquisition.

Phase 2 of the development is set to be finalized by August 31, 2025. This phase will involve the installation of hydro-cooled Bitmain S21+ ASICs, further enhancing the facility’s performance by adding an additional 6.5 EH/s of capacity. The Texas-based mining company has estimated the cost of completing the site at $400,000 per megawatt (MW). This will be funded through HIVE’s existing cash reserves and its Bitcoin holdings.

As part of this acquisition, HIVE will also take over $19 million in pre-existing power purchase agreement (PPA) deposits that Bitfarms had paid to the Paraguayan utility company ANDE. This acquisition aligns with HIVE’s strategic goal of expanding its Bitcoin mining capacity to 25 EH/s by September 2025. As of December 2024, HIVE reported a realized hashrate of 5.46 EH/s and held 2,805 BTC in its reserves. Additionally, the company has pre-ordered 15 EH/s worth of hydro-cooled ASIC miners from Bitmain and Canaan to further support its growth trajectory.

Conclusion

Despite this strategic pivot, Bitfarms remains committed to its operations in Latin America, where it currently operates three other facilities with a combined total capacity of 144 MW. These facilities are supported by long-term power agreements that ensure their continued operation.

This latest development follows the cancellation of a proposed merger between Bitfarms and Riot Platforms Inc. in 2024. The merger would have resulted in the creation of 15 mining facilities across various regions, including Paraguay. However, after careful consideration, Bitfarms’ board decided to reject the merger, leading to the termination of the acquisition attempt between the two companies.