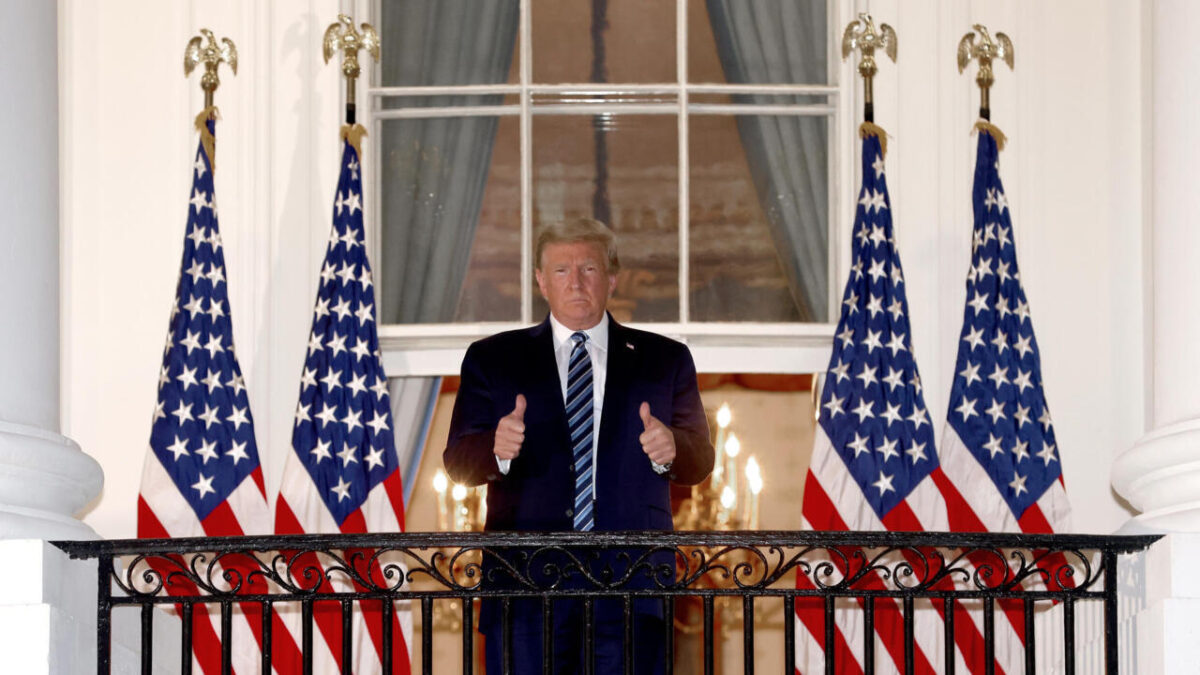

A Strategic Bitcoin Reserve is now a reality. President Trump has fulfilled a key campaign promise. He aims to make the U.S. the world’s Bitcoin leader. This move has ignited excitement across the crypto world.

Table of Contents

Trump’s Crypto Vision: A National Reserve

President Trump wants a national crypto stockpile. This reserve includes Bitcoin, Ethereum, XRP, Cardano, and Solana. This is like a gold or oil reserve for the digital age. The Strategic Bitcoin Reserve will back the U.S. position in finance. It will also solidify U.S. dominance in the crypto sector. Keeping a Strategic Bitcoin Reserve helps maintain dollar power. It also provides economic leverage in the crypto space. The reserve allows for market stabilization. This benefits U.S. crypto companies directly.

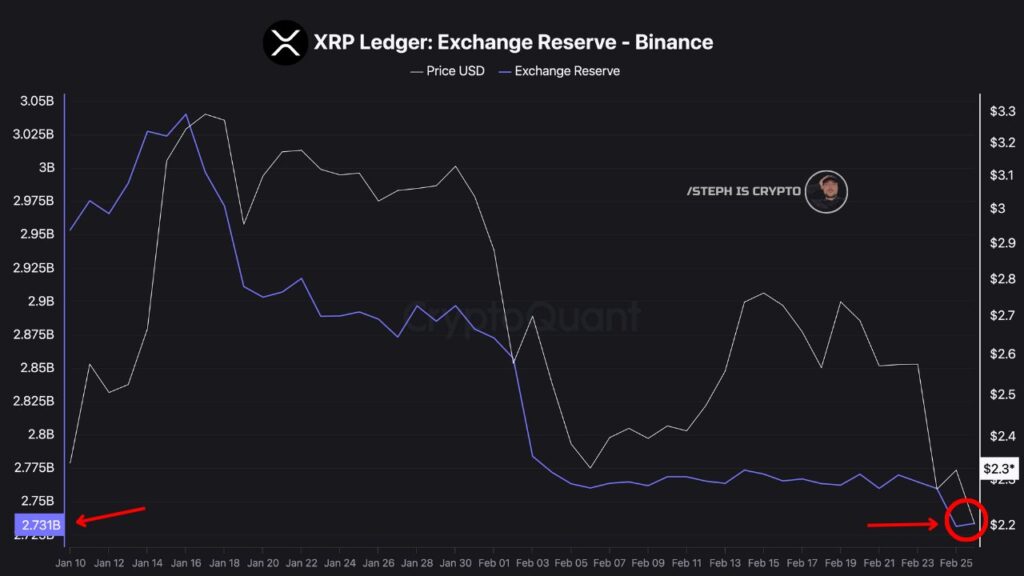

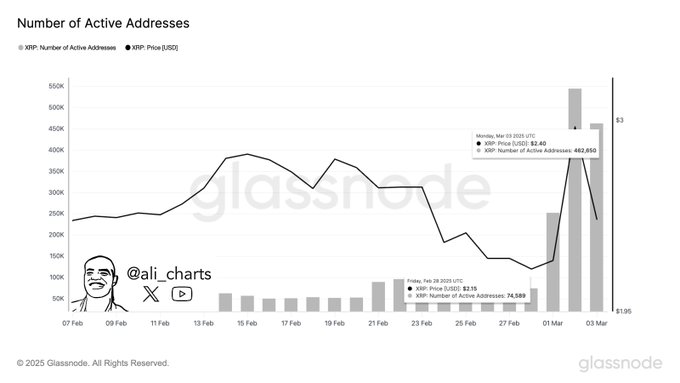

Trump announced the Strategic Bitcoin Reserve on Truth Social. Crypto prices immediately soared. Bitcoin neared $90K. XRP and Cardano saw massive gains. They increased by 30% and 60% respectively. This rally ended the market’s February downturn. The news added $300 billion in market value quickly. Traders are now optimistic about 2025. The Strategic Bitcoin Reserve has boosted market confidence.

Potential for a 2025 Bull Run

The Strategic Bitcoin Reserve could start a new bull run. Bull runs mean crypto prices rise rapidly. Investor confidence also increases. This reserve may boost institutional adoption. It can also increase market liquidity. Clearer regulations may follow. By including crypto in its reserves, the U.S. is setting a precedent. A Strategic Bitcoin Reserve is a major step. Past bull runs have shown huge gains. 2013, 2017, and 2020-2021 saw massive surges. 2024 also saw a large increase. Each run had its own catalysts. The 2024 run was due to ETF approvals and halving. The implementation of a Strategic Bitcoin Reserve is a potential catalyst.

The Impact of a National Crypto Reserve

Trump’s initiative is a big shift for crypto. It moves digital assets into national reserves. This could legitimize them as stores of value. Market volatility will still exist. But this reserve shows a new government approach. The Strategic Bitcoin Reserve could position the U.S. as a crypto leader. This could fuel a sustained bull market in 2025. The Strategic Bitcoin Reserve could change the world. The Strategic Bitcoin Reserve is a game changer.