American rapper Kanye West has publicly disclosed a shocking scam attempt, where fraudsters offered him $2 million to promote a meme coin bearing his name. This revelation adds to the growing concerns about scams in the cryptocurrency world and highlights the risks faced by influencers and celebrities in the space.

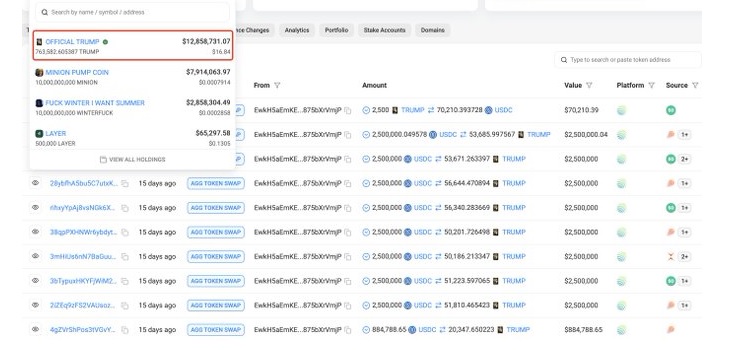

Kanye West shared details of the scam, where an unidentified group approached him with a lucrative offer to mislead his followers into promoting a fraudulent meme coin. The scam proposal included an upfront payment of $750,000, with an additional $1.25 million due if West posted the promotion for a minimum of eight hours.

To conceal the endorsement, the scammers suggested West could later claim his account had been hacked to explain the promotion. The fraudsters even admitted their intention was to steal “tens of millions of dollars” from the public.

I was proposed 2 million dollars to scam my community Those left of it I said no and stopped working with their person who proposed it pic.twitter.com/WKHdP9FkOq

— ye (@kanyewest) February 7, 2025

Why Kanye West Rejected the Scam

Despite the sizable offer, Kanye West rejected the deal, expressing that he had no intention of deceiving his followers. The rapper emphasized that his net worth had grown to $2.77 billion without endorsing any cryptocurrency or participating in fraudulent schemes.

“I was proposed 2 million dollars to scam my community-those left of it. I said no and stopped working with their person who proposed it,” West stated.

Kanye’s Move Towards Crypto: Seeking Guidance from Experts

Following his public rejection of the scam, West shared a conversation where he sought advice from respected figures in the crypto industry. One suggestion pointed him toward Coinbase CEO Brian Armstrong, signaling West’s growing interest in exploring the legitimate side of the crypto world.

West’s revelation raises concerns about the prevalence of similar scams involving high-profile figures on platforms like X (formerly Twitter). Over the past months, numerous celebrities and influencers have reported hacks that led to the promotion of dubious crypto projects.

However, some speculate that these “hacks” might not always be as genuine as they appear. Crypto influencer NotEezzy questioned whether the recent spate of high-profile account hacks promoting meme coins was part of a larger, coordinated scheme.

Yu Xian, a blockchain security expert and founder of SlowMist, confirmed that scams like these are rampant in the crypto space. He pointed out that while some compromised accounts are used to push fraudulent projects, scammers are also directly offering financial incentives to influencers for their participation.

“I believe this kind of scam exists. The scammers get a big influencer to act in the scheme, post a CA, and 8 hours later, the big influencer tweets that they got hacked. But with a prepayment of $750,000, is it that intense?” Xian noted.

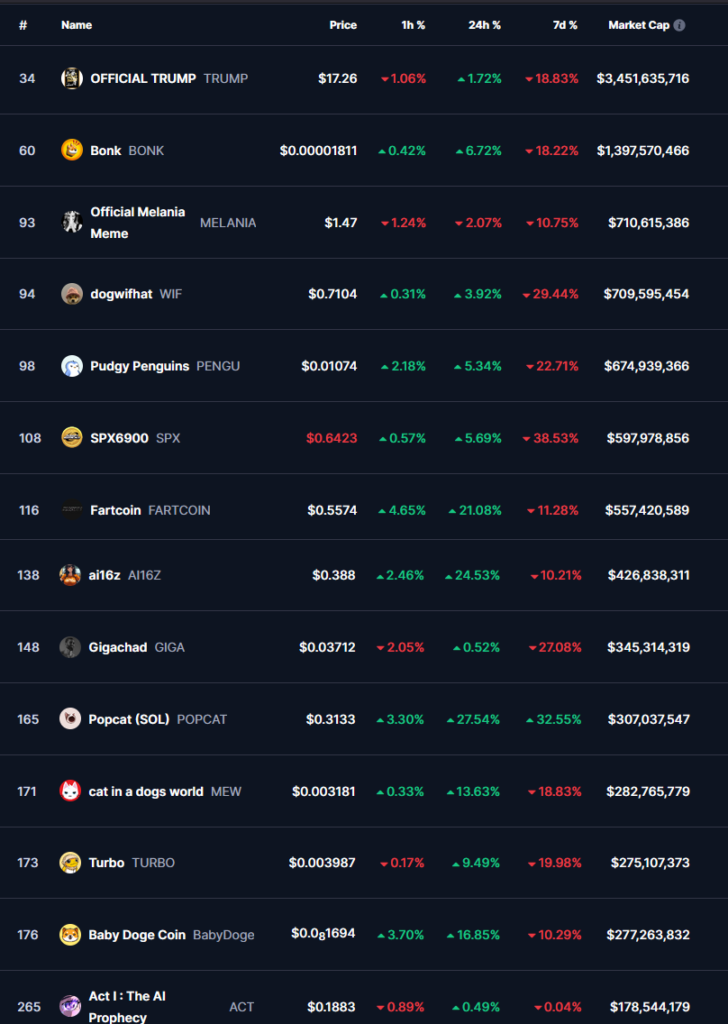

Celebrity-Backed Meme Coins: A Red Flag for Investors

The rise of celebrity-endorsed meme coins has created an atmosphere of uncertainty in the cryptocurrency market. These tokens, which are often promoted by famous personalities, are highly questionable and risky investments. The temptation to make quick money through fraudulent schemes, such as rug pulls, remains a significant concern for both influencers and their audiences.

Stay Cautious in the Crypto Market

As Kanye West’s experience highlights, celebrity endorsements in the cryptocurrency world should not be taken at face value. Users must remain cautious when dealing with crypto projects, especially those promoted by high-profile figures. Not all endorsement deals are legitimate, and the risks of falling victim to scams are high.

The cryptocurrency space is still rife with scams, and the involvement of celebrities only adds complexity to the situation. It’s crucial for users to conduct their own research and avoid blindly following celebrity endorsements. Always be cautious when it comes to investments promoted by influencers, and remember that not everything that glitters in the crypto world is gold.