The Beginning: Huge Profit from TRUMP Memecoin

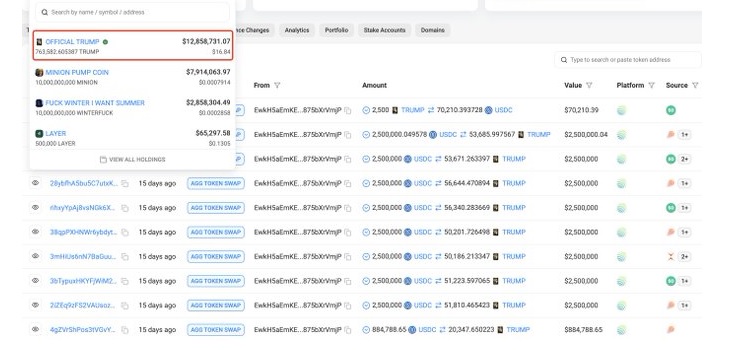

In a dramatic tale of crypto trading, a trader who once made an incredible $11 million profit with the TRUMP memecoin has now faced a crushing $21 million loss. This rollercoaster journey unfolded against the backdrop of a market crash fueled by trade tariffs, adding an unexpected twist to what initially seemed like a huge win. On January 18, the crypto trader sold 860,895 TRUMP tokens for a staggering $23.8 million. Having initially invested $12 million in the cryptocurrency, this sale led to a substantial profit of $11 million. The value of TRUMP tokens surged from $13.94 to $27.67, making this investment a huge success.

Reinvesting in TRUMP: A Risky Decision

Buoyed by earlier profits, the trader decided to double down by investing further. They purchased an additional 766,083 TRUMP tokens for $33.9 million, paying $44.25 per token. However, shortly after this significant purchase, the global market began to tumble.

Market Crash Triggered by Tariffs

The sudden market downturn was a direct result of tariffs imposed by the U.S. on China, Canada, and Mexico. This trade war, sparked by Donald Trump’s administration, sent financial markets into disarray. The value of the TRUMP memecoin plummeted, and so did the trader’s investment.

The Fall: $21 Million in Unrealized Losses

As of now, the trader’s holdings of 766,083 TRUMP tokens have lost significant value, now worth only $12.85 million. This dramatic drop in value means the trader has faced a loss of $21 million—erasing not only their earlier gains but also a substantial portion of their original investment.

This unfortunate turn of events isn’t isolated. The ongoing trade war between the U.S. and China has created volatility in financial markets worldwide, including the cryptocurrency market. The tariffs imposed by Trump’s administration have had an unpredictable impact, causing many digital assets to lose significant value.

The situation raises questions about the wider implications of Trump’s trade policies on the cryptocurrency space. Some analysts have speculated whether the tariffs were part of a larger strategy to impact markets, including digital currencies.

While the trade war and tariffs created turbulence, it’s important to note that Trump’s administration had a mixed approach toward cryptocurrency. While some members of his team showed interest in investing in digital assets like Ethereum, the broader economic policies, such as tariffs, had an adverse effect on the crypto market.

In an unexpected turn of events, Trump’s decision to temporarily halt tariffs on Canada and Mexico briefly helped improve market sentiment. This move sparked some optimism in the crypto market, but for traders like the TRUMP memecoin investor, the damage had already been done.

Conclusion:

This crypto trader’s experience serves as a reminder of the extreme volatility in digital asset markets. What started as a profitable venture with the TRUMP memecoin turned into a cautionary tale about the unpredictable nature of both the cryptocurrency world and global political influences. With the impact of trade wars still felt in financial markets, traders are left navigating a landscape marked by uncertainty and risk.