Changpeng “CZ” Zhao, the co-founder and former CEO of Binance, has once again sparked conversation around token listings on centralized exchanges (CEXs). This time, he raised concerns about the inefficiency and manipulation within the current token listing process, stressing the need for reform. According to CZ, the current system often results in price surges on decentralized exchanges (DEXs) before the token is even listed on a CEX, followed by significant sell-offs once the token makes its way to a more established exchange.

Listing Process Problems: Price Manipulation

The current process, according to CZ, creates a situation where tokens experience inflated prices on DEXs before being listed on CEXs. These tokens can often be bought at a higher price on DEXs, only to face sharp drops once they make their way to CEXs. This situation raises concerns about market manipulation and price volatility, which can harm both retail investors and the overall stability of the market. CZ noted that in the case of Binance, tokens are announced and listed within a very short window of time—often just four hours—which can lead to extreme price swings that are not beneficial for the market.

The Strain on Liquidity and Token Launches

The crypto market has seen a massive increase in the number of token launches in recent years, which is only adding to the strain on liquidity. With more projects entering the market each month, maintaining stability has become an increasingly difficult challenge. CZ pointed out that while token launches have surged, there is a lack of meaningful utility behind many of these new tokens, leading to a market flooded with speculative assets and memecoins. This flood of new projects is creating an imbalance, where utility-driven projects are being sidelined in favor of speculative trading.

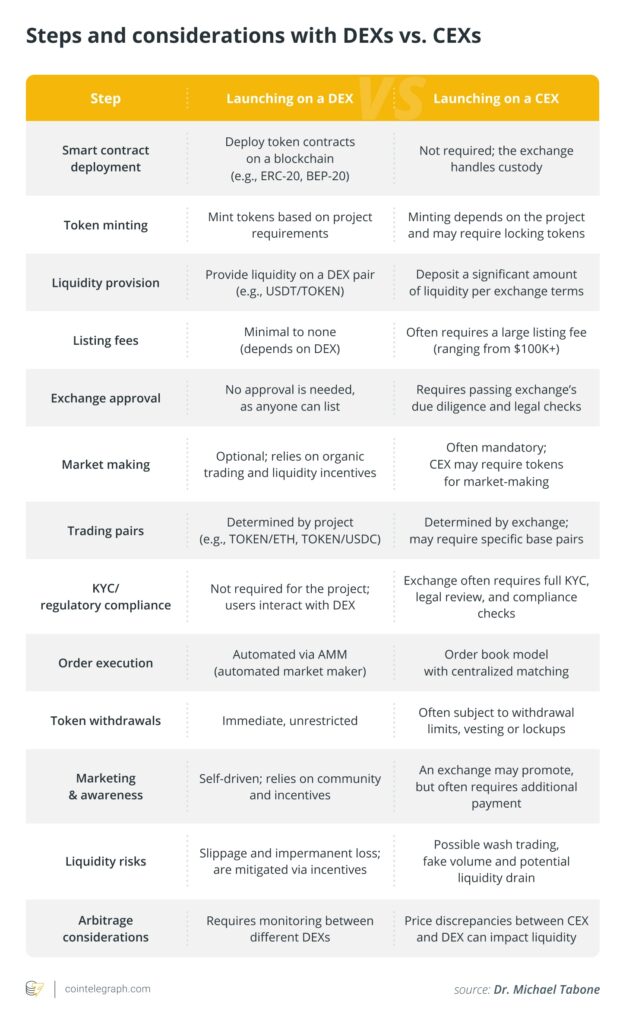

The Changing Crypto Landscape: DEX vs. CEX Listings

One of the primary concerns that CZ raised is the contrast between DEX and CEX listings. DEX listings are relatively easy to execute—projects just need to create a liquidity pair with an established asset. This ease of entry has led to a boom in DEX token launches. However, while DEXs are great for quick launches, they lack the liquidity and market exposure that centralized exchanges provide.

Despite DEXs facilitating billions of dollars in daily trading volume, CEXs remain the dominant players in the market, with over $165 billion in 24-hour trading. This difference in liquidity is a major factor in why many projects still aim for a CEX listing after launching on a DEX. The opportunity to tap into the broader CEX user base, which includes both retail and institutional investors, offers projects more exposure and a chance for sustained growth.

Venture Capital and CEX Listings: A Double-Edged Sword

Another critical point raised by CZ is the role of venture capital (VC) in token listings. Many of the top CEXs have VC arms, such as Binance Labs, Coinbase Ventures, and Kraken Ventures. These venture funds can provide projects with much-needed capital, exposure, and legitimacy. However, this relationship can create conflicts of interest, particularly when VC-backed projects receive preferential treatment for listings on exchanges.

While VC backing can help projects gain visibility, it can also lead to centralization of ownership, misaligned incentives, and rapid token dumping by early investors—often at the expense of retail investors. This issue of aggressive token dumping is a significant concern, as it leads to price manipulation and market instability, especially in the early stages of a project’s life.

How CEX Listings Have Evolved Over Time

Back in 2021, CZ placed significant emphasis on the importance of “users” when considering token listings on Binance. He argued that the number of active users on a project would be a key factor in determining its success. Fast forward to 2024, and the market has changed dramatically. With millions of tokens launching every month, the focus has shifted from utility to short-term trading gains. As the number of new tokens increases, the emphasis on utility has started to fade.

This shift has made it more difficult for projects that focus on long-term utility to succeed. The flood of new tokens has resulted in a situation where speculative and memecoin-driven assets dominate, and utility-based projects are increasingly being pushed aside. CZ’s commentary reflects the reality that the market has evolved into a much more volatile, fast-paced environment, where short-term gains are prioritized over long-term value.

The Challenges Faced by Organic Projects

For organic projects—those without significant VC backing—the challenges of listing on both DEXs and CEXs are even greater. One of the key hurdles is liquidity. To list on a CEX, projects must provide substantial liquidity across multiple trading pairs, which can be difficult for new projects without whales or institutional backing. Unlike DEXs, which allow projects to list with minimal requirements, CEXs impose strict criteria that often make it hard for smaller projects to compete.

Moreover, retail interest in tokens has become stagnant, with many investors chasing fast gains from short-term pumps rather than committing to long-term, utility-based projects. This trend further exacerbates the challenges that organic projects face in gaining exposure and liquidity.

Is the Market Ready for a Reformation?

CZ’s concerns about the current state of token listings on CEXs underscore a broader issue within the crypto industry. While he correctly identified the flaws in the current listing process, over-correcting the system could lead to unintended consequences. Striking the right balance between easing listing requirements and maintaining market integrity is crucial. A complete overhaul of the current process could potentially lead to even more issues, such as reduced liquidity and increased market manipulation.

The Path Forward for Token Listings

As the number of token launches continues to rise, the need for reform in the CEX listing process has never been more urgent. While the market is evolving rapidly, the focus on price manipulation and liquidity issues should remain a priority. By addressing these concerns, the crypto industry can move toward a more stable and sustainable future, where both speculative and utility-driven projects have a fair shot at success.