Ethereum Drives $2.24B Crypto Liquidation Amid Global Tariff Disputes

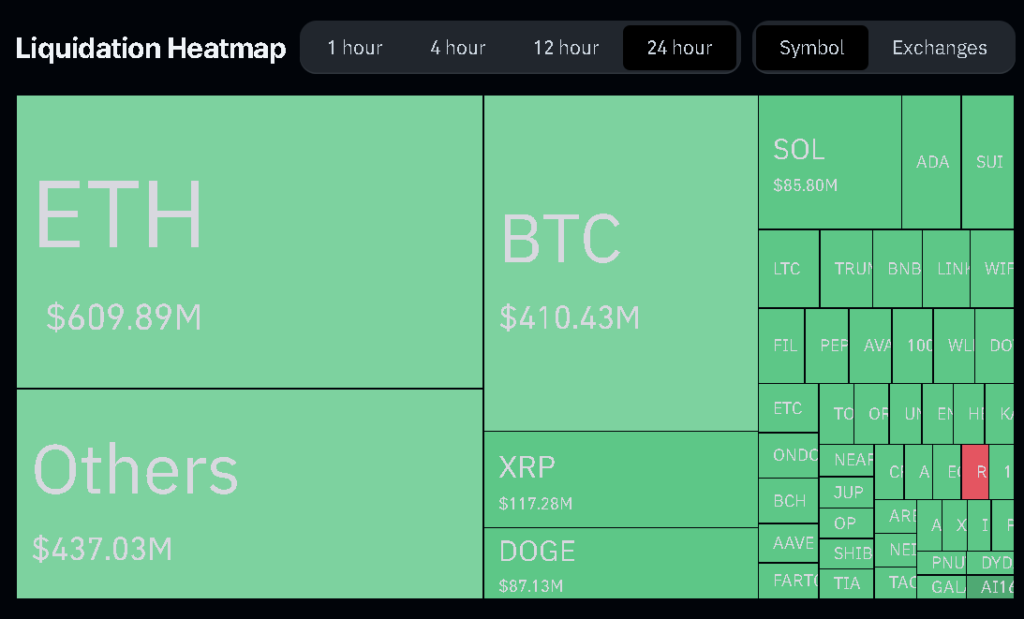

Over the past 24 hours, the cryptocurrency market experienced a dramatic decline, with over $2.24 billion in liquidations affecting more than 730,000 traders. This sell-off was largely driven by increasing geopolitical instability, particularly stemming from the global tariff war. Ethereum (ETH), the second-largest cryptocurrency, took center stage in the market downturn, with liquidations related to ETH reaching an astounding $609.9 million.

Analysts have compared this sudden crash to previous significant market events, such as the collapse of FTX and the COVID-19 market crash, given the scale and swift impact of the downturn. The largest liquidation occurred on the Binance exchange, with a notable order on the ETH/BTC trading pair valued at $25.6 million, as recorded by CoinGlass data.

Add Your Heading Text Here

The market’s turmoil was exacerbated by external factors, including the announcement of new tariffs by former U.S. President Donald Trump, targeting imports from China, Canada, and Mexico. This news triggered sharp price drops in leading altcoins, including ETH and Cardano (ADA), which lost double digits in value within a single hour. The liquidation event saw Binance take the brunt of the impact, accounting for 36.8% of the total liquidations, a reflection of its large user base. Other exchanges, such as OKX, Bybit, Gate.IO, and HTX, also saw significant liquidation volumes.

Add Your Heading Text Here

Long traders, who were betting on the continuation of a bullish market, bore the brunt of the losses, with a staggering $1.88 billion, or 84%, of the total liquidations affecting their positions. This suggests that many traders were overly optimistic about a market recovery, especially after the U.S. spot Bitcoin exchange-traded funds (ETFs) garnered nearly $5 billion in investments in January alone, signaling potential future inflows.

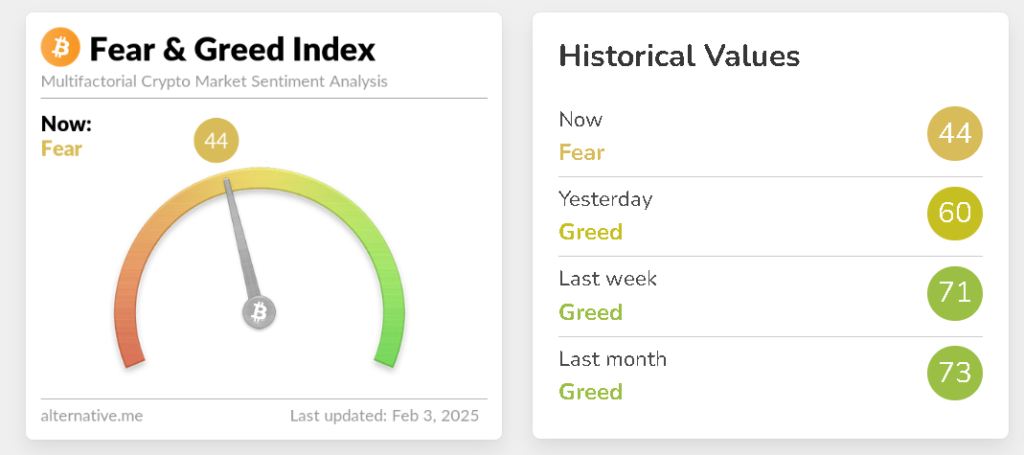

Despite the severity of the liquidations, the market’s reaction to such events has not been entirely negative. According to Joe Consorti, a leading analyst from Theya’s Bitcoin team, the impact of this recent liquidation event exceeded even those witnessed during the COVID-19 pandemic and the FTX crash. As of February 3, market sentiment remains in a state of “fear,” according to data from Alternative.me. This heightened anxiety is an indication that many crypto investors are becoming increasingly wary of their positions. However, history has shown that such extreme fear levels can sometimes present opportunities for savvy investors looking to buy at lower prices.

Conclusion

The combination of global political and economic factors, market uncertainty, and massive liquidations has left the crypto market on edge. With investor sentiment continuing to shift, only time will tell how the market will react in the coming weeks and whether these “fear” conditions will lead to potential buying opportunities for those ready to capitalize on the downturn.