The U.S. cryptocurrency market is experiencing a surge, and it’s reshaping the financial landscape. As Bitcoin, Ethereum, and other digital assets skyrocket in value, companies that deal with crypto trading, mining, and blockchain technology are reaping the rewards. With soaring trading volumes, businesses involved in crypto transactions are unlocking new revenue streams. However, as with any investment, there are risks involved. Cryptocurrencies can experience sharp declines, just as they rise. Here’s a look at key players leading the charge in the crypto revolution and how you can invest in crypto-exposed stocks.

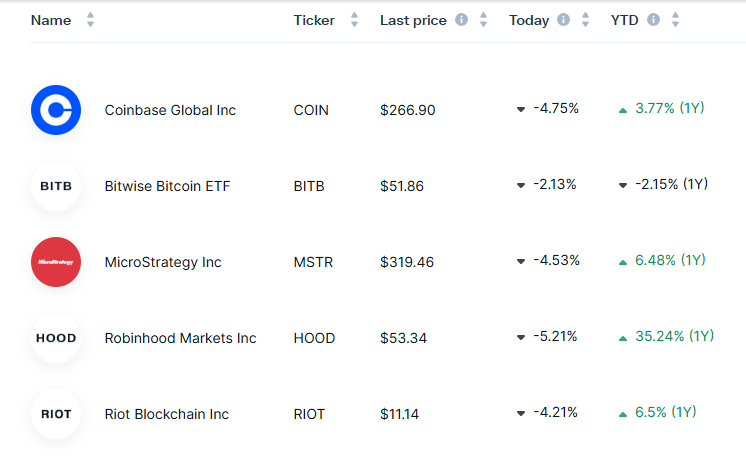

Coinbase Global (COIN): The U.S. Crypto Exchange Giant

Coinbase is the largest U.S. cryptocurrency market in the United States, offering a platform for trading popular digital assets such as Bitcoin and Ethereum. During crypto rallies, trading volumes typically soar, driving up revenue for Coinbase from its transaction fees. As the demand for crypto trading increases, Coinbase’s platform plays a crucial role in facilitating transactions and connecting investors to the crypto market.

MicroStrategy (MSTR): Corporate Bitcoin Investment Leader

MicroStrategy has positioned itself as a leader in corporate Bitcoin investments. With a significant portion of its balance sheet devoted to Bitcoin, the company benefits when cryptocurrency prices rise. However, the value of these holdings is also subject to market fluctuations. By integrating Bitcoin into its business strategy, MicroStrategy offers investors indirect exposure to the U.S. cryptocurrency market. This makes the company an attractive option for those looking to invest in Bitcoin through traditional stock ownership.

Robinhood Markets (HOOD): Easy Access for Retail Investors

Robinhood Markets has gained popularity for its user-friendly platform that allows retail investors to trade both traditional stocks and cryptocurrencies. As cryptocurrency prices surge, Robinhood has experienced a spike in activity, particularly among new investors drawn to its commission-free trading model. With its easy-to-use interface, Robinhood is becoming a go-to platform for individuals looking to enter the crypto space without the complexity of traditional investing platforms.

Bitcoin ETF (BITB): Direct Exposure to Bitcoin with Less Hassle

For those seeking direct exposure to Bitcoin without the challenges of owning and securing the digital asset themselves, the Bitcoin ETF (BITB) provides an ideal solution. Managed by Bitwise Asset Management, BITB offers a professionally managed exchange-traded fund that tracks Bitcoin’s price movements. This allows investors to benefit from Bitcoin’s growth potential while enjoying the ease of trading on traditional brokerage accounts. The Bitcoin ETF is an excellent choice for those who want to avoid the complexities of crypto ownership but still wish to capitalize on Bitcoin’s price volatility.

Riot Platforms (RIOT): A Key Player in Bitcoin Mining

Riot Platforms stands at the forefront of the cryptocurrency mining industry. By focusing on scaling its mining operations and enhancing energy efficiency, Riot is poised to capitalize on rising Bitcoin prices. However, like other mining companies, it is also vulnerable to the swings in cryptocurrency prices. Riot’s ability to mine Bitcoin at a lower cost than many competitors gives it a competitive advantage. As Bitcoin prices rise, Riot is well-positioned to reap the rewards of the crypto boom.

Why Invest in Crypto-Exposed Stocks?

Investing in companies tied to the cryptocurrency ecosystem allows you to participate in the growing market without directly owning digital assets. These companies are shaping the future of the crypto sector, and their stock performance often correlates with the success of cryptocurrencies. As the market evolves, these businesses stand to benefit from the increasing adoption and demand for digital currencies and blockchain technology.

The Risks of Crypto Investment: Volatility and Uncertainty

While investing in crypto-exposed stocks offers exciting growth opportunities, it’s important to be mindful of the risks. Cryptocurrencies are notoriously volatile, and prices can fluctuate drastically. The value of digital assets like Bitcoin and Ethereum can drop just as quickly as they rise, potentially leading to significant losses. As with any investment, you should consider your risk tolerance and investment objectives before diving into the crypto market.

Diversify Your Portfolio to Manage Risk

We believe in the importance of diversification. While cryptocurrencies can offer significant returns, it’s crucial to balance your exposure to this volatile market. A well-diversified portfolio can help mitigate risk while still allowing you to take advantage of the growth potential within the crypto space. We recommend limiting crypto investments to a small portion of your portfolio to ensure that your overall investment strategy remains balanced.

Capitalize on the Crypto Rally

The cryptocurrency rally presents unique opportunities for investors looking to tap into the booming digital asset market. By investing in companies that play a role in crypto trading, mining, and blockchain technology, you can benefit from the growing adoption of cryptocurrencies while managing your investment risk. However, it’s important to approach crypto investments with caution, understanding the volatility and risks involved. Always assess your financial goals, risk tolerance, and personal circumstances before diving into the crypto world.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial or investment advice.